Importing a $40,000 Used JDM Car from Japan to U.S.A.

Federal Taxes/Fees:

-

- Duty: 2.5% × $40,000 = $1,000 (unless over 25 years or USMCA-compliant).

-

- MPF: ~$5.77

-

- Gas-Guzzler Tax: $1,000 (if <22.5 mpg).

-

- New Tariff (post-Aug 9, 2025): 15% × $40,000 = $10,000 (if non-USMCA).

-

- Total Federal: ~$12,005.77

State Taxes:

-

- Use Tax (importer uses car): 7.25% × $40,000 = $2,900

-

- Sales Tax (retail sale): 9.5% (e.g., Los Angeles) × $40,000 = $3,800

-

- Compliance Costs: $2,000–$10,000 for RI modifications.

-

- Total: ~$54,905.77 (Federal + State taxes + Sales Tax + compliance estimate)

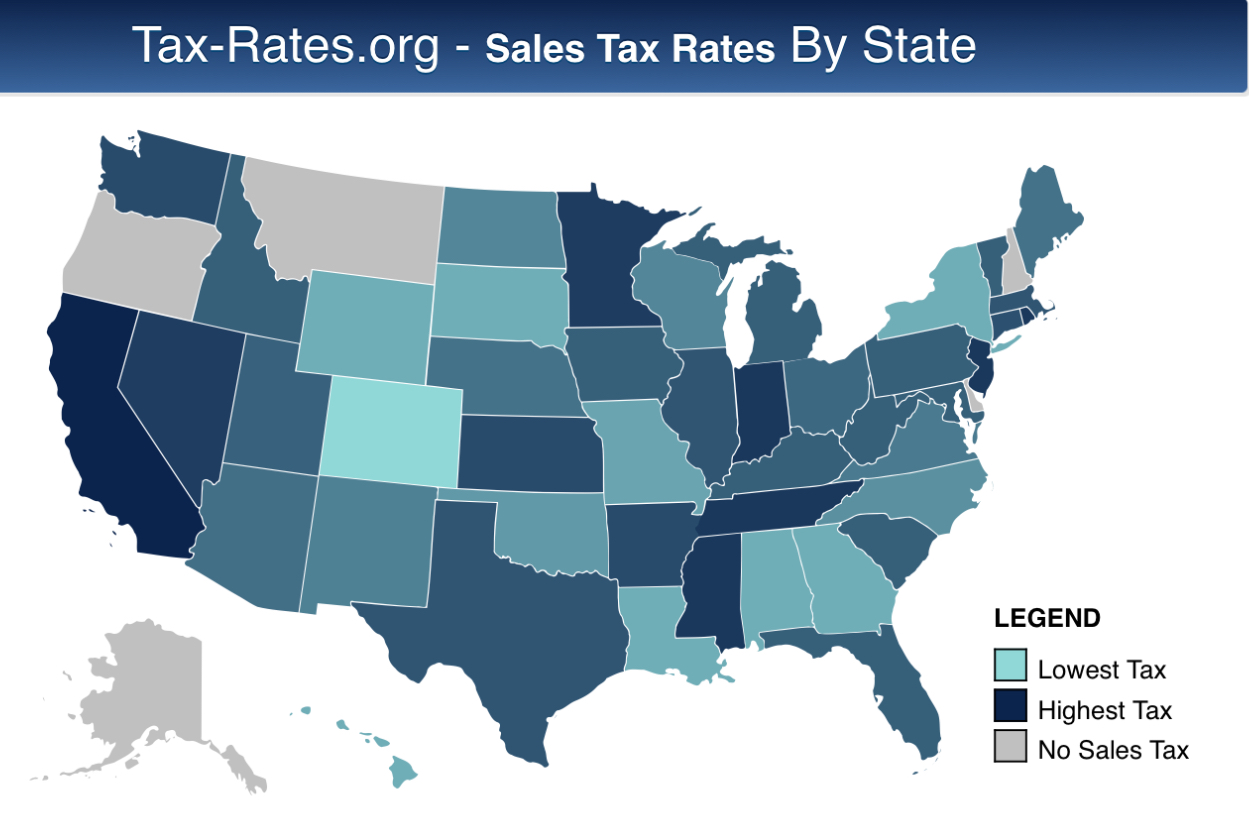

STATE |

SALES TAXES |

STATEWIDE SALES TAXES |

| Alabama |

4% |

765 Cities +4.56% |

| Alaska |

0% | 67 Cities +1.76% |

| Arizona |

5.6% | 511 Cities +2.57% |

| Arkansas |

6.5% | 644 Cities +2.76% |

| California |

7.5% | 2558 Cities +0.94% |

| Colorado |

2.9% | 560 Cities +4.54% |

| Connecticut |

6.35% | NO AVERAGE TAXES |

| Delaware |

0% | NO AVERAGE TAXES |

| Florida |

6% | 993 Cities +0.65% |

| Georgia |

7% | 961 Cities +2.96% |

| Hawaii |

4% | 69 Cities +0.35% |

| Idaho |

6% | 12 Cities +0.01% |

| Illinois |

6.25% | 1018 Cities +1.94% |

| Indiana |

7% | NO AVERAGE TAXES |

| Iowa |

6% | 893 Cities +0.78% |

| Kansas |

6.5% | 677 Cities +2.05% |

| Kentucky |

6% | NO AVERAGE TAXES |

| Louisiana |

4.% | 667 Cities +4.91 |

| Maine |

5.5% | NO AVERAGE TAXES |

| Maryland |

6% | NO AVERAGE TAXES |

| Massachusetts |

6.25% | NO AVERAGE TAXES |

| Michigan |

6% | NO AVERAGE TAXES |

| Minnesota |

6.88% | 231 Cities +0.33% |

| Mississippi |

7% | 5 Cities +0.07% |

| Missouri |

4.23% | 1090 Cities +3.58% |

| Montana |

0% | NO AVERAGE TAXES |

| Nebraska |

5.5% | 149 Cities +1.30% |

| Nevada |

6.85% | 249 Cities +1.09% |

| New Hampshire |

0% | NO AVERAGE TAXES |

| New Jersey |

7% | NO AVERAGE TAXES |

| New Mexico |

5.13% | 419 Cities +2.22% |

| New York |

4% | 2158 Cities +4.48% |

| North Carolina |

4.75% | 1012 Cities +2.15% |

| North Dakota |

5% | 126 Cities +1.56% |

| Ohio |

5.75% | 1424 Cities +1.35% |

| Oklahoma |

4.5% | 762 Cities +4.27% |

| Oregon |

0% | NO AVERAGE TAXES |

| Pennsylvania |

6% | 227 Cities +0.34% |

| Rhode Island |

7% | NO AVERAGE TAXES |

| South Carolina |

6% | +1.13% |

| South Dakota |

4% | 142 Cities +1.83% |

| Tennessee |

7% | 779 Cities +2.45% |

| Texas |

6.25% | 2176 Cities +1.80% |

| Utah |

5.95% | 340 Cities +0.73% |

| Vermont |

6% | 19 Cities +0.14% |

| Virginia |

5.3% | 1199 Cities +0.33% |

| Washington |

6.5% | 726 Cities +2.39% |

| West Virginia |

6% | 39 Cities +0.07% |

| Wisconsin |

5% | 816 Cities +0.43% |

| Wyoming |

4% | 167 Cities +1.47% |

| Washington DC |

6% |